As we wind down 2022, now is a good time to examine your financial situation and think about the future. Read this post to see what the numbers are saying.

How Much House Can I Afford? Here’s What the Numbers Say

As we’re winding down 2022, interest rates are now up to 7% on a 30-year fixed mortgage. This can discourage you from home ownership, but you shouldn’t give up yet.

I take you through the numbers behind figuring out the maximum amount you can afford for your dream home. And overall, how much you need to make to afford a home in the current market. I’ll also show you how much property prices should fall for you to afford them at your current income level.

How Interest Rates Affect Affordability

The higher the interest rate, the more expensive your monthly mortgage payment will be. We’ll compare the prices of homes at the beginning of 2022 when the interest rates were 3% versus at the end of 2022 when they rose to 7%.

Example 1:

For a $400,000 home, with a 20% downpayment, 2% closing costs, and a 30-year fixed mortgage at 3%, your monthly payment (principal and interest only) would be $1,350 per month. But at a 7% interest rate, that same home would have a monthly payment of $2,130, an increase of $780 per month (58% increase).

Example 2:

For a home that’s $700,000 with the same down payment of 20% and closing costs (2%), the monthly payment at a 3% rate would be $2,360. But at a 7% rate, the mortgage payment would jump to $3,725 per month. That’s $1,365 more per month (58% increase).

Income and Affordability

As income rises, so does the amount you can afford for your dream home. As a general rule of thumb, your monthly housing expenses shouldn’t exceed 30% of your gross income.

So, if you spent 20% of your monthly income on a home at the beginning of 2022, you could afford a $400,000 home if your income was $81,000 per year. But with a 7% interest rate, the same home requires you to earn $127,800 per year.

For a $700,000 home, you’ll need a $141,600 annual income at 3% interest, or $223,500 annual income if the interest rate is 7%.

As you can see, interest rates have a significant impact on your affordability. We see a 58% increase in monthly payments in the two examples above. It’s important to keep track of these rates and consider them when deciding on a home purchase. Don’t forget to also factor in property taxes, homeowners insurance, and other potential expenses.

The Home Price Correction We Need

Right now we can’t expect a drastic drop in home prices, as demand for housing remains high as the low inventory continues. However, I predict a modest correction in prices over the next year or two as supply catches up and interest rates come down to about 5%.

If we achieve a 5% interest rate and the home that’s currently priced at $400,000 drops to $320,000, a monthly mortgage payment at 20% down would make the monthly payment $1375. That’s significant savings and allows more potential homebuyers to afford a home.

The housing market needs to have some price correction, as it helps maintain a healthy market and prevents pricing from getting out of reach for many buyers. As always, make sure to do your research on current rates and prices, and consult with real estate professionals.

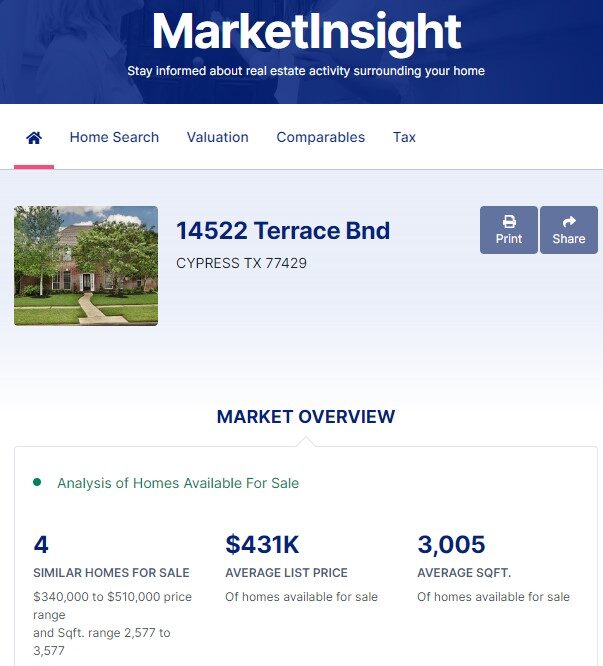

Need Help Understanding the Local, Texas Real Estate Market?

If you need help understanding the local, Texas real estate market and figuring out how much house you can afford, reach out to me through this website. I will work with you to find the perfect home for your budget and needs.